Friday 20 December 2024 7:35 am

| Up to date:

Friday 20 December 2024 7:49 am

Retail gross sales edged up in November as a powerful efficiency from UK supermarkets helped offset a pointy fall in clothes retailer gross sales.

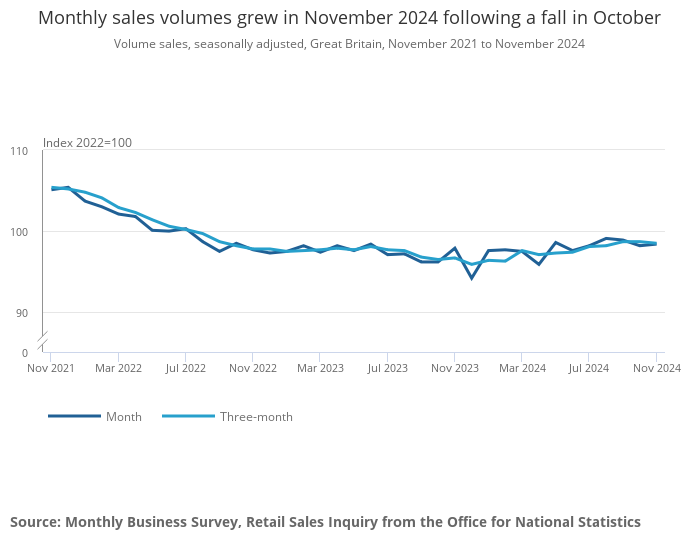

The most recent information from the Workplace for Nationwide Statistics confirmed retail gross sales have been up 0.2 per cent final month, following a 0.7 per cent fall in October.

Nevertheless, the rise was nonetheless a lot lower than economists had anticipated and comes amid concern over a more durable than common “golden quarter” main as much as Christmas, following the wide-ranging tax hikes introduced in Rachel Reeves’ Autumn Funds.

The ONS mentioned there had been a 0.3 per cent quarter-to-quarter rise within the three months to November.

Gross sales elevated 1.9 per cent when put next with the identical interval final 12 months, nevertheless the golden quarter of 2023 was one of many worst-performing within the UK in additional than half a decade.

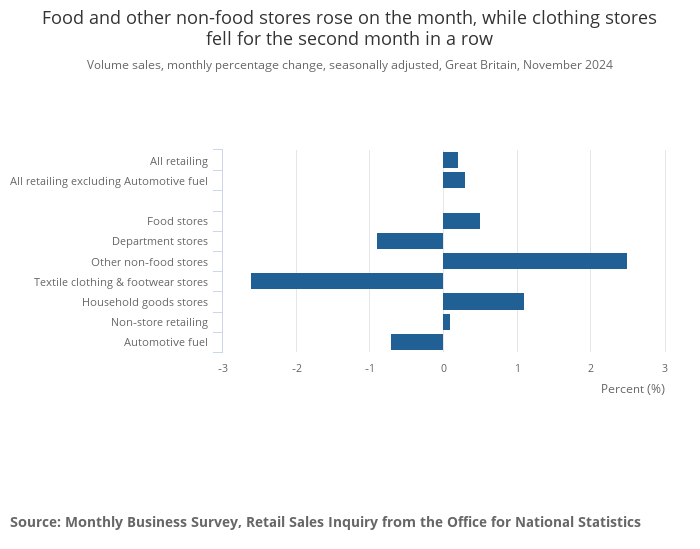

“Retail gross sales elevated barely in November following final month’s fall. For the primary time in three months there was a lift for meals retailer gross sales, notably supermarkets,” Hannah Finselbach, senior statistician on the ONS, mentioned.

“It was additionally month for family items retailers, most notably furnishings outlets. Clothes retailer gross sales dipped sharply once more, as a retailers reported robust buying and selling circumstances.”

Neil Birrell, Chief Funding Officer at Premier Miton Traders, mentioned the outcomes recommend the customers is “feeling the pinch in a sluggish economic system.”

“With the Financial institution of England retaining rates of interest on maintain and inflation within the system, there are considerations round development prospects as we go into the brand new 12 months. Christmas is a key interval for retail gross sales and can give an additional clue on brief time period outlook and should affect the BoE at its subsequent assembly.”

Retail gross sales fall on Funds uncertainty earlier than run-up to Christmas

Clothes retailer gross sales fell by 2.6 per cent in November, following a 3.5 per cent fall in October and leaving clothes retailer gross sales volumes at their lowest degree since January 2022.

On-line gross sales additionally fell, with the quantity spent on-line – often called “on-line spending values” – dropping 4.3 per cent final month, the biggest fall since March 2022.

British retailers have warned of an additional £2.5bn price burden due to tax hikes together with a rising Nationwide Insurance coverage invoice. They’re additionally involved over a slower-than-expected rise in gross sales from final 12 months’s disastrously poor golden quarter.

A survey from the British Retail Consortium (BRC) on the finish of September discovered one third of customers anticipate to spend much less on garments over the interval, and round 1 / 4 anticipate to spend much less on electronics, magnificence and leisure.

Kris Hamer, director of perception on the British Retail Consortium, mentioned: “After a optimistic begin to the Golden Quarter, November gross sales stagnated, with greater power payments and low client sentiment impacting spending.”

“Clothes suffered from a fall in gross sales, with milder climate placing many off updating their winter wardrobe. Customers have been additionally holding out for the primary black Friday gross sales week to select up magnificence and electrical offers, which noticed their first falls of the 12 months. The ultimate two months of the 12 months account for over one-fifth of all gross sales, making it a interval of important significance – notably for non-food. With a weak November efficiency, retailers will hope that buyers come out in drive within the remaining days earlier than Christmas.

“Given the shaky begin to the festive season, retailers will probably be the £7bn in new prices from the Funds dealing with the business in 2025 with elevated concern.”

“Larger employer nationwide insurance coverage contributions, a better Nationwide Residing Wage, and a brand new packaging levy will heap stress on an business that’s already paying greater than its justifiable share of tax. With gross sales development unable to maintain tempo, retailers may have no alternative however to lift costs or reduce prices – closing shops and freezing recruitment. To mitigate this, Authorities should be sure that its proposed enterprise charges reform doesn’t lead to any store paying greater charges than they already do.”

Share

Fb Share on Fb

X Share on Twitter

LinkedIn Share on LinkedIn

WhatsApp Share on WhatsApp

E-mail Share on E-mail